About Us:

We’ve made it our life’s work to help you enjoy and preserve the payoff from your life’s work. Your financial life is about more than a spreadsheet to us — you’ll never feel like just a number here.

Ben Earls, CFP®

Financial Advisor

Ben is a Certified Financial Planner® Professional and has been helping families preserve wealth since 2018. He previously spent 6 years working with physicians and nurses in the ER and in medical sales. He discovered the CFP Board while helping patients navigate insurance issues and reading up on personal financial planning topics for his family. He quickly decided to make a career change and hasn’t looked back since. Ben believes his clients deserve caring, competent, commission-free retirement advice and he’s on a mission to make sure they get it.

Brenda Earls

Operations Manager

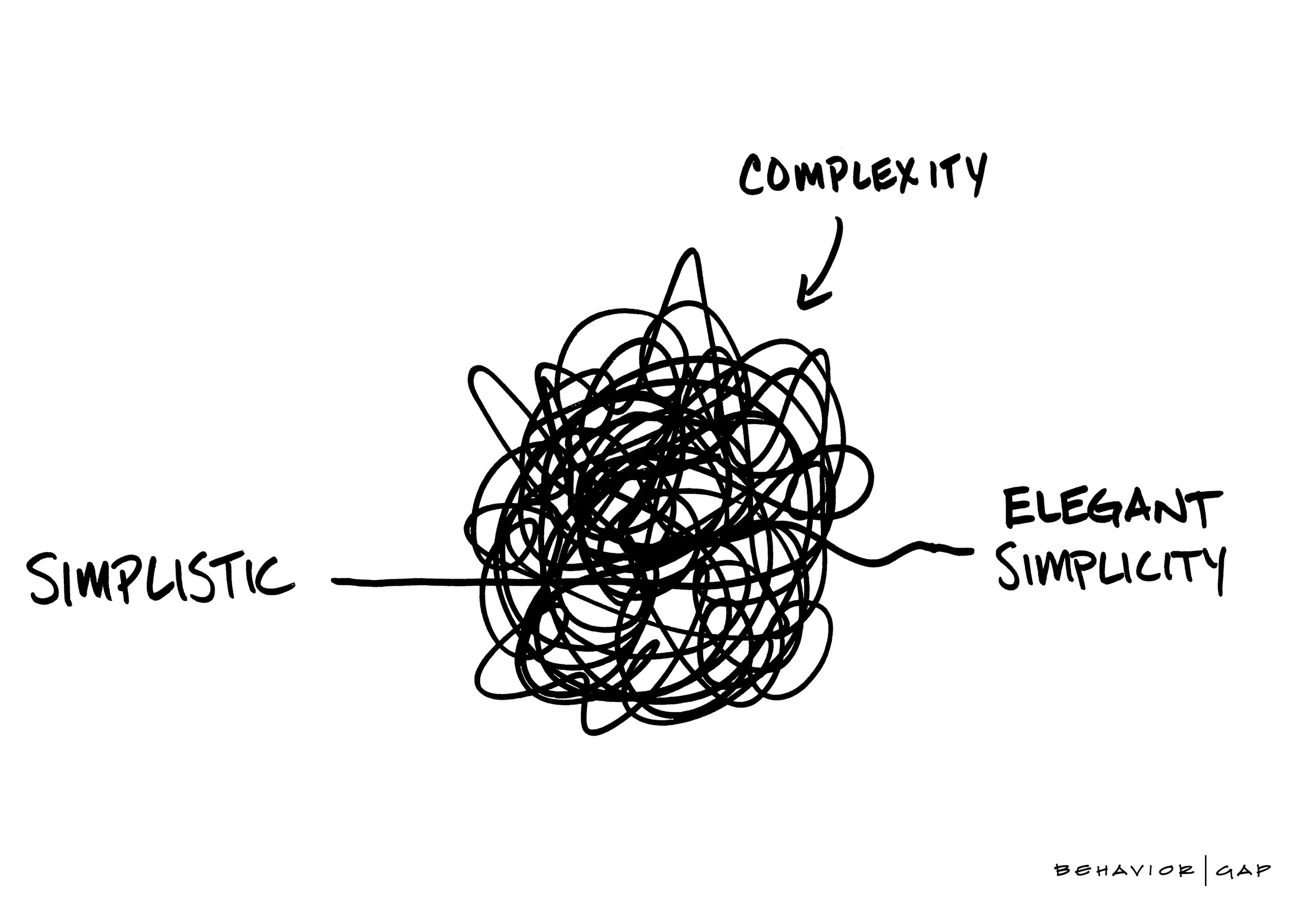

Brenda received her bachelor’s degree from Dallas Baptist University in education, and is a former public school elementary teacher. She knows how challenging and rewarding each day can be as an educator and can relate to the chaos. She has a passion for bringing clarity to our clients by helping navigate the complexities of TRS benefits and integrating them into the overall plan. She’s a superstar when it comes to executing a plan with precision and efficiency, so the firm relies heavily on her to get things done and help clients stay on track.

Earls Financial is a fiduciary, fee-only Registered Investment Advisor based in Fort Worth. We serve pre-retirees and retirees in Texas — good folks who have built $1M+ portfolios and who want tax-efficient, evidence-based retirement income and wealth management strategies. We serve clients both virtually and by appointment.

About You:

You’ve done well for yourself.

You’ve lived below your means, saved diligently, and made smart decisions (mostly).

You’ve followed the rules, and paid your fair share in taxes. You’ve raised kids as well as you know how, sacrificing your time and money for them.

And now you’re so ready to move onto the next chapter, it ain’t even funny. Because now it’s your turn. This is your time.

Time to travel. Time to be with the grandkids. Time to enjoy your money.

You’d like to relax a bit. You’d prefer not to have any surprises with your retirement income.

You want to manage your risks and avoid costly mistakes. You want to coordinate your income streams with a holistic plan to maximize your income.

You also want legal ways to minimize your tax bill.

And with all of the uncertainty in the world right now, you want a sense of control over your financial future. You want to feel confident that you’re making the right moves.

Because you didn’t come this far just to let your life’s work go to waste.

I hear you. I’m here to help you get what you want.

If you’re a pre-retiree trying to make critical decisions about your retirement income plan, I’ve already done the heavy lifting for you.

I’ve done the research. I’ve put in the time to be in a position to help you get what you want.

You just need to decide you’re ready to work with a retirement income planner who can save you time, money and/or stress as you start to enjoy the next chapter.

But to tell you the truth, we’re not the right financial advocate for everyone.

We don’t take on every business opportunity that comes our way.

We serve pre-retirees and retirees in Texas — good folks who have worked hard to build $1M+ portfolios who want tax-efficient, evidence-based, time-tested retirement income and wealth preservation strategies.

Our 100-household Ark is headed toward the Promised Land and we’re running out of room. Once it’s full, it’s full.

And that’s great news for our clients! They’ll continue to receive the attention they deserve, personalized recommendations, and customized investment advice for their unique situation.

Here’s what we’re doing for them:

It really works well for our clients and allows them to focus on other things like family, traveling, and staying healthy.

We may be able to do something similar for you.

But before we could get into any detailed prescriptions for your unique situation, we’d need to first get to a diagnosis. And we can’t do that without learning a bit about each other.

Hi — we’re Ben and Brenda Earls. Nice to “meet” you virtually 👋.

I (Ben) am a CERTIFIED FINANCIAL PLANNER® PROFESSIONAL. Brenda is the Operations Manager of Earls Financial and she keeps things running smoothly and efficiently at our firm.

One of the reasons I became a CFP® professional is to help people like my Grandma. After Grandpa died in 2015 I had no idea how to help her with the life insurance death benefit she received.

It’s something that still haunts me to this day.

Now, I’ve made it my mission to help my clients enjoy and preserve their wealth. I want them to have peace of mind and avoid mistakes.

Because if I had known then what I know now, I wouldn’t have any regrets. I would’ve been able to deliver the right advice at the right time to the right person.

But I wasn’t a financial planner then. I didn’t know what I didn’t know. And I absolutely don’t regret where it led me.

It drove me to learn more about investing, make a career change, and it continues to remind me that I NEVER want to let that happen again.

Now pre-retirees and retirees look to us when they need help focusing on the most critical questions affecting their retirement:

How much money do I need to retire?

When can I retire/make work optional?

How much income will I have (and from where)?

What if something happens to me (or my spouse)?

How do I account for inflation, taxes, and healthcare?

What risks should I be worried about?

Which investments are right for me?

Do I need a will or a trust?

What if I inherit money?

How can I legally lower my taxes?

Should I have a Roth conversion plan?

When should I take Social Security?

What are my healthcare options?

What about Medicare and IRMAA?