Our Services

-

We’ll help you answer questions like, “How much do I need to retire?”, “When can I retire?”, “How much income can I count on?”, and “How can I put it all together by coordinating income streams, increasing tax efficiency, and managing my portfolio risk?”

-

Our process will get your investments aligned with your personal situation and goals, manage portfolio risk, and make sure your money is working efficiently for you and your family.

-

You’ll get answers to questions like, “Which investment vehicles are most tax-efficient for my situation?”, “How can I maximize my tax bracket?”, and “Are there legal ways to lower my tax tax bill?”

-

You’ll get help with questions like, “Am I protected from common retirement mistakes?”, “Is my portfolio invested appropriately?” and “What about healthcare/long-term care?”

-

We’ll help you think through a trust vs a will, and make sure your beneficiary designations align with your wishes. Our trusted attorney referrals will draw up the legal documents, but we’ll address estate planning together in our process.

-

If you’d like more investment flexibility, distribution planning, and investment management (and it makes sense for your situation), we’ll help you move retirement funds to appropriate accounts like an IRA or Roth IRA.

-

We’ll work on questions like, “When should I turn on Social Security benefits?”, “What if something happens to me (or my spouse)?”, and “How do I maximize guaranteed income so I worry less about other investments?”

-

We’ll implement this if it makes sense and answer questions like, “How can I maximize my current tax bracket?” and “How can I pay less taxes over my lifetime?”

-

We can help you answer questions like, “Are all annuities bad?” and “How can I get pension-like income for (a portion of) my core expenses?”

Customized Retirement Income Planning: Our premium service

Step 1

Intro Coffee Meeting

We start to get to know each other by asking questions and seeing if we’re a good fit to work together. There’s no obligation (for either of us) to do so.

Step 2

Retirement Income Plan

We ask you more questions to get an idea of where you are and where you want to go from here. We’ll start to put together a retirement income plan.

0.99% AUM

No commissions

No 12b-1 fees

No revenue sharing on the back end

We’re a fee-only, fiduciary firm that strives to reduce conflicts of interest. While no business model is conflict-free, we have found our model (assets under management) aligns our interests with yours and is a good proxy for complexity. It provides an incentive for us to be invested in your retirement outcome and encourages the best possible service throughout our relationship. Please feel free to ask any questions about how we’re compensated.

Step 3

Strategy Sessions

Ongoing customized retirement income planning and wealth management services, as well tax, estate, and charitable gift planning.

Strategy Sessions

If you don’t meet our portfolio minimum for our premium service but still need guidance, we’ll help you with personalized strategy sessions.

We typically charge $500/session to people off the street (e.g. people not referred by current clients). But right now we’re offering strategy sessions at a discounted rate of $250/session for folks over 50 who need help with retirement income planning. Everyone gets a free Intro Coffee Meeting, so start with that by clicking the “Get Started Now” button below.

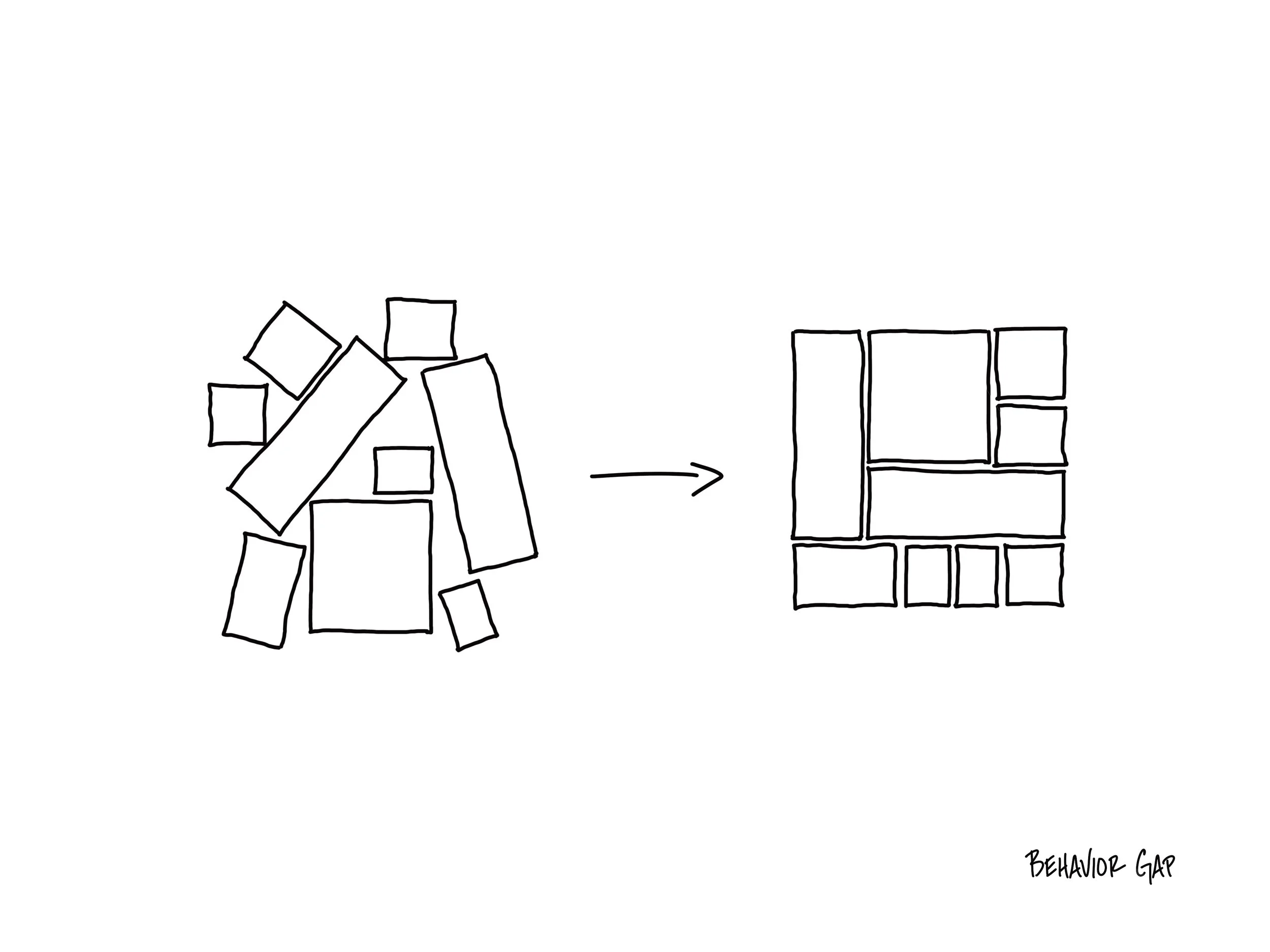

Big picture, here’s a sketch of what we’re trying to do.

Here’s how we’ll do it.

This is what it’ll feel like.

Frequently Asked Questions

-

Yes! You can schedule a no cost, no obligation Intro Coffee Meeting here.

-

We’re a fee-only firm. We do not accept commissions of any kind and we strive to reduce conflicts of interest when and where we can.

-

We manage assets at Charles Schwab and offer pension-like income options with third party vendors.

-

We use evidence-based investing strategies (like the kind Warren Buffett championed when he said, “The stock market is a wonderfully efficient mechanism for transferring wealth from the impatient to the patient.”)

-

No. In-person meetings are great, and we do that regularly. We also work virtually with many of our clients via zoom, phone calls, and review videos to keep you up to date.